Sustainable Change, Powered by Smart Loans: Akhuwat Foundation

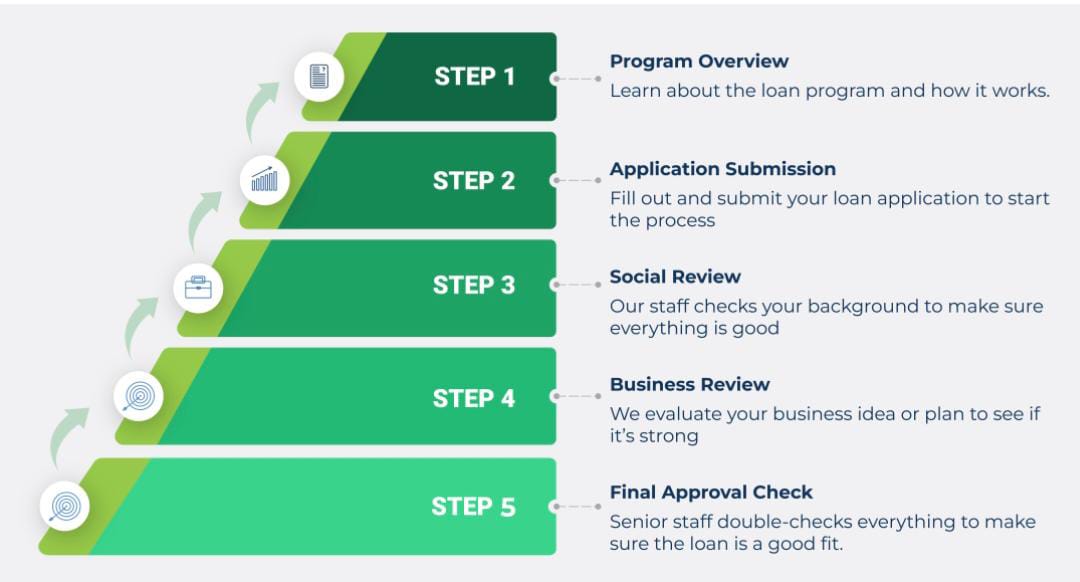

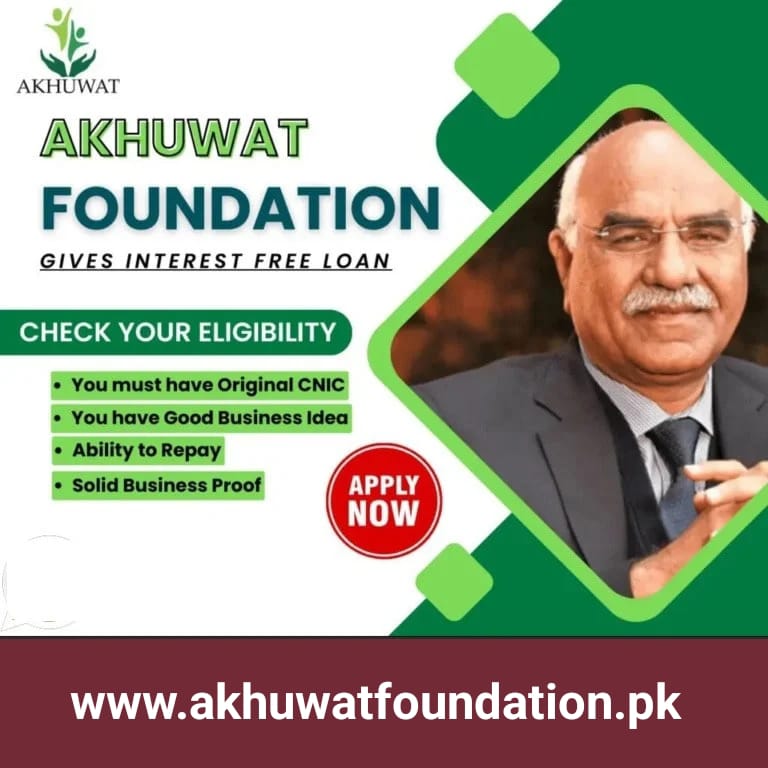

At Akhuwat Foundation, we are committed to responsible and informed lending. By harnessing data-driven insights, we make sure every loan—be it for microfinance, education, or healthcare—sparks real impact and fosters sustainable growth.

0

K+

Projects Done

0

+

Years Experience